You are currently browsing the tag archive for the ‘No Free Lunch’ tag.

Fig. – A Symbolical Head (phrenological chart) illustrating the natural language of the faculties. At the Society pages / Economic Sociology web page.

You have much probably noticed by now how Scoop.it is emerging as a powerful platform for those collecting interesting research papers. There are several good examples, but let me stress one entitled “Bounded Rationality and Beyond” (scoop.it web page) curated by Alessandro Cerboni (blog). On a difficult research theme, Alessandro is doing a great job collecting nice essays and wonderful articles, whenever he founds them. One of those articles I really appreciated was John Conlisk‘s “Why Bounded Rationality?“, delivering into the field several important clues, for those who (like me) work in the area. What follows, is an excerpt from the article as well as part of his introductory section. The full (PDF) paper could be retrieved here:

In this survey, four reasons are given for incorporating bounded rationality in economic models. First, there is abundant empirical evidence that it is important. Second, models of bounded rationality have proved themselves in a wide range of impressive work. Third, the standard justifications for assuming unbounded rationality are unconvincing; their logic cuts both ways. Fourth, deliberation about an economic decision is a costly activity, and good economics requires that we entertain all costs. These four reasons, or categories of reasons, are developed in the following four sections. Deliberation cost will be a recurring theme.

Why bounded rationality? In four words (one for each section above): evidence, success, methodology, and scarcity. In more words: Psychology and economics provide wide-ranging evidence that bounded rationality is important (Section I). Economists who include bounds on rationality in their models have excellent success in describing economic behavior beyond the coverage of standard theory (Section II). The traditional appeals to economic methodology cut both ways; the conditions of a particular context may favor either bounded or unbounded rationality (Section III). Models of bounded rationality adhere to a fundamental tenet of economics, respect for scarcity. Human cognition, as a scarce resource, should be treated as such (Section IV). The survey stresses throughout that an appropriate rationality assumption is not something to decide once for all contexts. In principle, we might suppose there is an encompassing single theory which takes various forms of bounded and unbounded rationality as special. cases. As with other model ingredients, however, we in practice want to work directly with the most convenient special case which does justice to the context. The evidence and models surveyed suggest that a sensible rationality assumption will vary by context, depending on such conditions as deliberation cost, complexity, incentives, experience, and market discipline. Beyond the four reasons given, there is one more reason for studying bounded rationality. It is simply a fascinating thing to do. We can mix some Puck with our Hamlet.

Video lecture by Ken Long (at the Statistics Problem Solvers blog) on Nassim Taleb‘s 4th Quadrant problems [1,2], i.e. a region where statistics not only don’t work but in which statistics are downright dangerous, because they lead you to make predictions as well as control systems that are unprepared for the kinds of systems shocks awaiting you.

“Statistical and applied probabilistic knowledge is the core of knowledge; statistics is what tells you if something is true, false, or merely anecdotal; it is the “logic of science”; it is the instrument of risk-taking; it is the applied tools of epistemology; you can’t be a modern intellectual and not think probabilistically—but… let’s not be suckers. The problem is much more complicated than it seems to the casual, mechanistic user who picked it up in graduate school. Statistics can fool you. In fact it is fooling your government right now. It can even bankrupt the system (let’s face it: use of probabilistic methods for the estimation of risks did just blow up the banking system).”, Nassim Taleb, in [1].

[1] Nassim Nicholas Taleb, “The Fourth Quadrant: A Map of the Limits of Statistics“, An Edge Original Essay, Set., 2008. (link)

[2] Nassim Nicholas Taleb,”Convexity, Robustness, and Model Error inside the Fourth Quadrant“, Oxford Lecture (Draft version), Oxford, July 2010. [PDF paper]

“It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is the most adaptable to change“. Charles Darwin (On the Origin of Species, Nov. 1859)

During the Victorian era where high prudery and morality were constant, it would be hard to imagine seeing Charles Darwin wearing a Scottish-kilt. In fact, men’s formal clothing was less colourful than it was in the previous century, while women’s tight-fitting jersey dresses of the 1880s covered the body, leaving little to the imagination (source). There is however, one beautiful – as in strict sense of delighting the senses for exciting intellectual or emotional admiration – reason, I think he should have done it (!), regardless the obvious bearing consequences of a severe Victorian society. Surprisingly, some how, that reason is linked to cheetahs chasing gazelles, among many other things…

As the image of Charles Darwin wearing a kilt, you will probably find these awkward too, but when a cheetah chases a gazelle, banded tartan Scottish-kilt woven textile like patterns soon start to pop-up everywhere. Not at the ground terrain level, of course. Instead, they appear as a phenotype-like map between your present and the past. You may think that this banded tartans will have no significance for your life, but do mind this: crying babies do it all the time with their mommy’s and fathers, companies do it with other companies in their regular business, people commuting in large cities do it over large highways, human language, literature and culture does it, friends do it, PC virus and anti-virus software do it, birds singing do it also, … and even full countries at war do it.

One extreme example is the Cold War, where for the first time on our Human history, co-evolutionary arms-race raised to unprecedented levels. Co-Evolution is indeed the right common key-word for all these phenomena, while large white banded strips punctuated by tiny black ones (bottom-left woven kilt above), would be the perfect correspondent tartan pattern for the case of the Cold War example mentioned. But among these, there is of course, much more Scottish-kilt like patterns we could find. Ideas, like over this TV ad above, co-evolve too. Here, the marketeer decided to co-evolve with a previous popular famous meme image: Sharon Stone crossing his legs at the 1992 ‘Basic Instinct‘ movie. In fact, there is an authentic plethora of different possible behavioural patterns. Like a fingerprint (associated with different Gaelic clans), each of these patterns correspond to a lineage of current versus ancestral strategies, trying to solve a specific problem, or achieving one precise goal. But as the strategic landscape is dynamically changing all the time, a good question is, how can we visualize it. And, above all, what vital information and knowledge could we retrieve from this evolutionary Scottish-kilts maps.

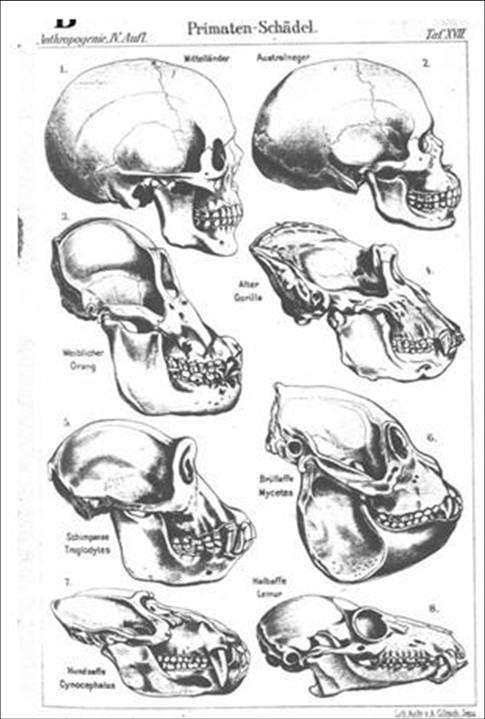

Fig. – The frontispiece drawing to the English edition of Ernst Haeckel‘s Evolution of Man (trans. 1903) presents a skull labelled “Australian Negro” as an intervening evolutionary stage between the “Mediterranean” skull and those of the lower primates (from the 1891 ed. of the Anthropogenie).

Fig. – The frontispiece drawing to the English edition of Ernst Haeckel‘s Evolution of Man (trans. 1903) presents a skull labelled “Australian Negro” as an intervening evolutionary stage between the “Mediterranean” skull and those of the lower primates (from the 1891 ed. of the Anthropogenie).

In nature, organisms and species coexist in an ecosystem, where each species has its own place or niche in the system. The environment contains a limited number and amount of resources, and the various species must compete for access to those resources, where successive adaptations in one group put pressure on another group to catch up (e.g., the coupled phenomena of speed in the cheetah and evasive agility in the gazelle). Through these interactions, species grow and change, each influencing the others evolutionary development [7]. This process of bi-adaptive relationship (in some cases can also assume a form of cooperation and mutualism) or reciprocal adaptation is know as Co-evolution, i.e. the evolution of two or more competing populations with coupled fitness.

The phenomena has several interesting features that may potentially enhance the adaptive power of artificial evolution [7], or other types of bio-inspired learning systems. In particular, competing populations may reciprocally drive one another to increasing levels of complexity by producing an evolutionary “arms race”, where each group may become bigger, faster, more lethal, more intelligent, etc. Co-Evolution can then happen either between a learner (e.g., single population) and its environment (i.e. based on competitions among individuals in the population) or between learning species (two populations evolving), where the fitness of individuals is based on their behaviour in the context of the individuals of the other population [7]. This latter type of co-evolutionary search is often described as “host-parasite”, or “predator-prey” co-evolution. A good example and application of co-evolutionary learning include the pioneering work by Hillis in 1990 [1] on sorting networks.

It can occur at multiple levels of biology: it can be as microscopic as correlated mutations between amino acids in a protein, or as macroscopic as co-varying traits between different species in an environment. Being biological Co-Evolution, in a broad sense, “the change of a biological object triggered by the change of a related object” [2], his visualization however, could be profoundly hard. In fact, attempting to define and monitor “progress” in the context of Co-Evolutionary systems can be a somewhat nightmarish experience , as stated in [4]. It’s exactly here where Scottish-kilts come into play.

In 1995 [3], two researchers had a simple, yet powerful idea. In order to monitor the dynamics of artificial competitive co-evolutionary systems between two populations, Dave Cliff and Geoffrey Miller [3,4,5] proposed evaluating the performance of an individual from the current population in a series of trials against opponents from all previous generations. while visualizing the results as 2D grids of shaded cells or pixels: qualitative patterns in the shading can thus indicate different classes of co-evolutionary dynamic. Since their technique involves pitting a Current Individual (CI) against Ancestral Opponents (AO), they referred to the visualizations as CIAO plots (fig. above [3]).

In 1995 [3], two researchers had a simple, yet powerful idea. In order to monitor the dynamics of artificial competitive co-evolutionary systems between two populations, Dave Cliff and Geoffrey Miller [3,4,5] proposed evaluating the performance of an individual from the current population in a series of trials against opponents from all previous generations. while visualizing the results as 2D grids of shaded cells or pixels: qualitative patterns in the shading can thus indicate different classes of co-evolutionary dynamic. Since their technique involves pitting a Current Individual (CI) against Ancestral Opponents (AO), they referred to the visualizations as CIAO plots (fig. above [3]).

Important Co-Evolutionary dynamics such as limited evolutionary memory, “Red Queen” effects or intransitive dominance cycling, will then be revealed like a fingerprint as certain qualitative patterns. Dominance cycling, for instance, it’s a major factor on Co-Evolution, wish could appear or not, during the entire co-evolutionary process. Imagine, for instance, 3 individuals (A,B,C) or strategies. Like over the well known “Rock, Paper, Scissors” game, strategy B could beat strategy A, strategy C could beat B, and strategy A could beat C, over and over in an eternal cycling, where only “arms race” specialized learning will emerge, at the cost of a limited learning generalization against a possible fourth individual-strategy D. If you play poker, you certainly know what I am talking about, since 2 poker players are constantly trying to broke this behavioural cycle, or entering it, depending on their so-far success.

Above (left and right figures – [3]), two idealised typical CIAO plot patterns can be observed, where darker shading denotes higher scores. On the left figure, however, co-evolutionary intransitive dominance cycling is a constant, where current elites (population A elites) score highly against population B opponents from 3, 8 and 13 generations ago, but not so well against generations in between. On the other hand (right figure), the behavioural pattern is completely different: over here we do observe limited evolutionary memory, where the current elites do well against opponents from 3,4 and 5 generations ago, but much less well against more distant ancestral opponents.

“For to win one hundred victories in one hundred battles is not the acme of skill. To subdue the enemy without fighting is the acme of skill.” ~ Sun Tzu

Of course, in increasingly complex real-world situations Scottish-kilt like CIAO plots are much noisy than this (fig. above -[7]) where banded tartans could be less prominent, while the same could happen in irregular dominance cycling as elegantly showed by Cartlidge and Bullock in 2004 [6]. Above, some of my own experiences can be observed (submitted work). Over here I decided to co-evolve a AI agent strategy to play against a pool of 15 different strategies (6 of those confronts are presented above), and as a result, 6 different behavioural patterns emerged between them. All in all, the full spectrum of co-evolving dynamics could be observed, from the “Red Queen” effect, till alternate dominant cycles, and limited or long evolutionary memory. Even if some dynamics seem counter-productive in one-by-one confronts, in fact, all of these dynamics are useful in some way, as when you play Poker or the “Rock, Paper, Scissors” game. A typical confront between game memory (exploitation) and the ability to generalize (exploration). Where against precise opponents limited evolutionary memory was found, the same effect produced dominant cycles or long evolutionary memory against other strategies. The idea of course, is not to co-evolve a super-strategy to win all one-by-one battles (something that would be rather impossible; e.g. No free Lunch Theorem) but instead to win the whole round-robin tournament, by being highly adaptive and/or exaptive.

So next time you see someone wearing a banded tartan Scottish-kilt do remind yourself that, while getting trapped in traffic, that precise pattern could be the result of your long year co-evolved strategies to find the quickest way home, while confronting other commuters doing the same. And that, somewhere, somehow, Charles Darwin is envying your observations…

.

[1] W. Daniel Hillis (1990), “Co-Evolving Parasites improve Simulated Evolution as an Optimization Procedure”, Physica D, Vol. 42, pp. 228-234 (later in, C. Langton et al. (Eds.) (1992), Procs. Artificial Life II, Addison-Welsey, pp. 313-324).

[2] Yip et al.; Patel, P; Kim, PM; Engelman, DM; McDermott, D; Gerstein, M (2008). “An integrated system for studying residue Coevolution in Proteins“. Bioinformatics 24 (2): 290-292. doi:10.1093/bioinformatics/btm584. PMID 18056067.

[3] Dave Cliff, Geoffrey F. Miller, (1995), “Tracking the Red Queen: Methods for measuring co-evolutionary progress in open-ended simulations“. In F. Moran, A. Moreno, J. J. Merelo, & P. Cachon (Eds.), Advances in artificial life: Proceedings of the Third European Conference on Artificial Life (pp. 200-218). Berlin: Springer-Verlag.

[4] Dave Cliff, Geoffrey F. Miller, (2006), “Visualizing Co-Evolution with CIAO plots“, Artificial Life, 12(2), 199-202

[5] Dave Cliff, Geoffrey F. Miller (1996). “Co-evolution of pursuit and evasion II: Simulation methods and results“. In P. Maes, M. J. Mataric, J.-A. Meyer, J. Pollack, & S. W. Wilson (Eds.), From Animals to Animats 4: Proceedings of the Fourth International Conference on Simulation of Adaptive Behavior (pp. 506-515). Cambridge, MA: MIT Press.

[6] Cartlidge, J. and Bullock S., (2004), “Unpicking Tartan CIAO plots: Understanding irregular Co-Evolutionary Cycling“, Adaptive Behavior Journal, 12: 69-92, 2004.

[7] Ramos, Vitorino, (2007), “Co-Cognition, Neural Ensembles and Self-Organization“, extended abstract for a seminar talk at ISR – Institute for Systems and Robotics, Technical Univ. of Lisbon (IST), Lisbon, PORTUGAL. May 31, 2007.

Two “The Economist” covers. The first one was manually created and posted by Richard Dawkins himself, … – yes – the evolutionary Biologist. The second one is real as well recent (as of April 4th) – UNDER ATTACK, a 14-page special report on the rise and fall of the wealthy. Do note the Blackberry on top of the dead guy in the front and the skyline of London’s Canary Warf financial district in the background (via HS Dent blog). The Laissez-faire Economy lead to all this (more).

It’s not everyday we see a 40 year ideology collapsing through a dramatic act of contrition. It has happened just a few hours ago (check video above), yesterday in the “financial crisis” congressional hearing in Washington (23. Oct. 2008). Moreover, what seems remarkable, is that the recognition comes from one of his most universally respected founding fathers and defenders.

Alan Greenspan was the longest serving chairman in the Federal Reserve board history (1987-2006), and during this 18-year period of time he were perhaps the leading proponent of de-regulation along with libertarian capitalism, vividly expressed on his “The Age of Turbulence – Adventures in a New World” 2007 book, advocating above all issues, Adam Smith’s “Invisible Hand” that markets can regulate themselves. As it’s known, for his whole adult life, the former Fed chairman has been a devotee of the philosophy of Ayn Rand, who celebrated free-market capitalism as the world’s most moral economic order and advocated a strict laissez-faire approach to government regulation of the marketplace. Ironically, he was a regulator that did not believed in any regulation at all.

It is now quite a remarkable historic moment seeing former Federal Reserve chairman, a lifelong champion of free markets, publicly questioning the philosophy that guided him throughout his years as the world’s most powerful economic policymaker. A philosophy followed and strongly defended by him (along with many others like Margaret Thatcher and Ronald Reagan), at least in the last 40 years, as he himself acknowledged yesterday. Asked by the congressional committee chairman, whether his free-market convictions pushed him to make wrong decisions, especially his failure to rein in unsafe mortgage lending practices, Greenspan replied that indeed he had found a flaw in his ideology, one that left him very distressed. “In other words, you found that your view of the world, your ideology was not right?” he was asked:

“Absolutely, precisely“, replied Greenspan. “That’s precisely the reason I was shocked, because I have been going for 40 years or more with very considerable evidence it was working exceptionally well“. Albeit he was surely one of the most influential voices for de-regulation: “There is nothing in Federal regulation that makes it superior to Market regulation”, said Greenspan back in 1994, in one among many of his past radical free-market statements.

I presume we now all wonder, where was Greenspan, when back in 2003 one of the most prestigiously recognized and legendary financial investors such as Warren Buffet, called credit default obligations and derivatives “weapons of financial mass destruction“? Or where was he when Princeton Professor of Economics, Paul Krugman – the recent Nobel laureate – said back in 2006 that “If anyone is to blame on the current situation (sub prime) is Mr Greenspan who poopooed warnings about an emerging bubble and did nothing to crack down on irresponsible lending“. Or what did he, Greenspan itself, said just a few days after ENRON collapsed?

People working in complex systems – and surely financial markets are one of them (yes, for the past 4-5 years including these present turbulent times I am working hard in this area as well) – for long know that any systemic structure could collapse if only positive-feedbacks are injected into them, creating an auto-catalytic snow-ball effect, leading among other things to a power-law like Black Swan. Indeed power-laws are a striking powerful signature. This is specially true when we address self-organization (read it in the present context as self-regulation). In order to be a truly self-regulated system, financial markets should also be embedded with negative-feedbacks as well, as I have addressed in a post about finance and complex systems one month ago. In fact, in order to emerge as a truly self-organized system, self-interest, should constitute just one among many of the ingredients over the entire financial system, and not the isolated unique ingredient. Self-interest promotes amplification and positive feedback, which is – as I recognize – necessary. However, left alone, promotes instead dramatic snowballing drifts over chaotic regimes, due to it’s intrinsic amplification. What’s amazing (at least for me), is that Alan Greenspan just recognized that in a tiny few seconds along his current discourse (check video above), pointing it to the precise key-word:

[…] I made a mistake in presuming that the self-interest of organizations, specifically banks and others, was such that they were best capable of protecting their own shareholders. […] So the problem, here is something which looked to be as a very solid edifice, and indeed a critical pillar to market competition and free-markets, did breakdown and I think that, as I said, shock me. I still do not fully understand why it happened, and obviously to the extend, that I figure out where it happened and why, … aaaaaa, … I will change my views. If the facts change I will change. […]

As a result, “the whole intellectual edifice” of risk management collapsed, Greenspan said. In what regards his unexpected words yesterday at the congressional hearing, at least, I frankly praise him for his huge intellectual courage and present honesty. In the end, it seems that during the past 18 years, former FED chair was nothing else then a simple-man driven by his own blind faith on markets, from which he apparently comes out now. Unfortunately, only now at a very high price. Meanwhile as we know, severe consequences are here to stay, as was already evident when Greenspan addressed the House Financial Services Committee on 2003 (video below). Let’s hope that all these will not be forgotten in 3 decades from now (though, I doubt it – after all, nothing really serious came out from the entitled 3-man dream-team Bush-Sarkozy-Barroso “new global finance order” summit at Camp David last weekend, as expected):

“You have told the American people that you support a trade policy which is selling them out.” – Rep. Bernard Sanders to Federal Reserve Chairman Alan Greenspan on 7/16/03. Rep. Bernard Sanders (Independent-Vermont), now a US Senator, dresses down Federal Reserve Chairman Alan Greenspan in front of the House Financial Services Committee on 7/16/03.

[…] A hedge fund firm that reaped huge rewards betting against the market last year is about to open a fund premised on another wager: that the massive stimulus efforts of global governments will lead to hyperinflation. The firm, Universa Investments L.P., is known for its ties to gloomy investor Nassim Nicholas Taleb, author of the 2007 bestseller “The Black Swan,” which describes the impact of extreme events on the world and financial markets.

[…] A hedge fund firm that reaped huge rewards betting against the market last year is about to open a fund premised on another wager: that the massive stimulus efforts of global governments will lead to hyperinflation. The firm, Universa Investments L.P., is known for its ties to gloomy investor Nassim Nicholas Taleb, author of the 2007 bestseller “The Black Swan,” which describes the impact of extreme events on the world and financial markets.

Recent Comments